Money Laundering Definition Placement

The concept of money laundering is very important to be understood for those working within the financial sector. It is a course of by which dirty cash is converted into clear money. The sources of the cash in actual are felony and the money is invested in a means that makes it appear to be clean cash and hide the id of the felony part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the brand new customers or sustaining current customers the obligation of adopting satisfactory measures lie on each one who is part of the group. The identification of such ingredient to start with is simple to cope with instead realizing and encountering such conditions later on within the transaction stage. The central bank in any country offers full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide enough security to the banks to discourage such conditions.

To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion. This step must occur so that the criminal disposes of cash derived from a criminal source.

Ppt Anti Money Laundering Awareness Training Powerpoint Presentation Id 730997

Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways.

Money laundering definition placement. Placement may occur by itself or concurrently with the subsequent two stages. Money laundering usually consists of three steps. There are three stages involved in money laundering.

Placement is the most difficult step. Cash generated from crime is placed in the financial system. Money Laundering is an act of act of disguising the illegal source of income.

The stages of money laundering include the. Accordingly the first stage of the money laundering process is known as placement Placement. Initial entry or placement is the initial movement of an amount of money earned from criminal activity into some legitimate financial network or institution.

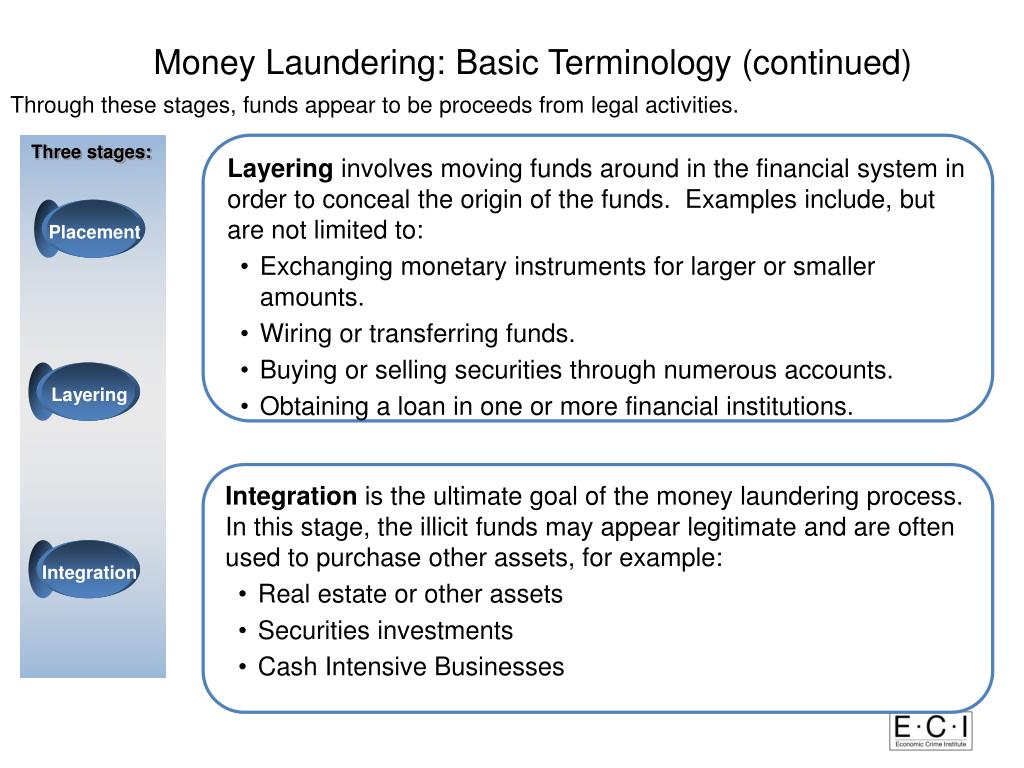

Placement layering and integration. Or participating in or assisting the movement of funds to make the proceeds appear legitimate. The money laundering process is divided into 3 segments.

Stage 1 of Money Laundering. In the initial - or placement - stage of money laundering the launderer introduces his illegal profits into the financial system. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

There are three acknowledged phases to money laundering. The money laundering cycle can be broken down into three distinct stages. On occasion the source can be.

By ICAS Practice Support 11 January 2019 Money laundering has one purpose. Money laundering is the conversion or transfer of property. Funneling illegal funds through legitimate businesses that deal heavily in cash transactions.

Money laundering is the illegal process of making large amounts of money generated by a criminal activity such as drug trafficking or terrorist funding appear to have come from a legitimate. Its very easy to define but involves multiple techniques. However it is important to remember that money laundering is a single process.

Criminals may use several methodologies to place illegal money in the legitimate financial system including. The concealment or disguising of the nature of the proceeds. A simpler definition of money laundering would be a series of financial transactions that intend to transform ill-gotten gains into legitimate money or other assets.

The Placement Stage Filtering. Placement layering and integration. Layering is the continuing transfer of the money through multiple transactions forms investments or enterprises to make it virtually impossible to trace the money back to its illegal origin.

After getting hold of illegally acquired funds through theft bribery and corruption financial criminals move the cash from its source. Meaning of Money Laundering. The first stage of money laundering is known as placement whereby dirty money is placed into the legal financial systems.

Placement This is the movement of cash from its source. However the broader definition of money laundering offences in POCA includes even passive possession of criminal property as money laundering. So Money Laundering is.

Placement is the depositing of funds in financial institutions or the conversion of cash into negotiable instruments. Placement is the first stage of the money laundering process and is the stage during which money is most vulnerable to detection and seizure. Money Laundering is the process of changing the colors of the money.

Placement The first stage of money laundering placement requires the placement of criminally-derived proceeds in the financial system. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Placement layering and integration.

Here are some of the most common ways this is achieved. Process of Money Laundering. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the.

Some common methods of laundering are. The acquisition possession or use of property knowing that these are derived from criminal activity. Definition of Money Laundering.

Money Laundering refers to converting illegally earned money into legitimate money.

Cryptocurrency Money Laundering Explained Bitquery

Risks Free Full Text Efficiency Of Money Laundering Countermeasures Case Studies From European Union Member States Html

The Phases Of Money Laundering Download Scientific Diagram

Understanding Money Laundering European Institute Of Management And Finance

What Is Money Laundering Three Methods Or Stages In Money Laundering

Money Laundering Typology Through Business Structures Entities An Overview From Company Law Perspective Sudut Pikir

What Are The Stages Of Money Laundering Process The Money Laundering Cycle Can Be Broken Down Into Three Distinct Stages

Anti Money Laundering Overview Process And History

What Is Anti Money Laundering Aml Anti Money Laundering

Doc Basics Of Money Laundering Doc Abdinasir Ali Academia Edu

Pdf Introduction To Money Laundering Ghulam Alosh Academia Edu

3 Stages Of Money Laundering Techniques Anti Money Laundering

The world of laws can appear to be a bowl of alphabet soup at instances. US cash laundering rules are not any exception. We now have compiled a listing of the top ten money laundering acronyms and their definitions. TMP Risk is consulting agency centered on defending financial companies by decreasing danger, fraud and losses. We have massive financial institution experience in operational and regulatory threat. We now have a powerful background in program management, regulatory and operational threat in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many antagonistic penalties to the organization because of the dangers it presents. It will increase the probability of main risks and the opportunity value of the bank and in the end causes the financial institution to face losses.